During the Back to School season, students tend to purchase new electronic items, so it’s essential for brands to optimize their ecommerce strategies for this period. According to a report by mordorintelligence, the Earphones and Headphones Market size is expected to grow from USD 55.52 billion in 2023 to USD 95.68 billion by 2028, with a CAGR of 11.50% during the forecast period (2023-2028).

Wireless devices are driving growth in this market, specifically earbud type devices, which have grown multifolds in presence ever since the launch of Airpods by Apple in 2016. Apart from this, advancements in technology have helped bring the product prices down and enabled a wide range of customers to get access to features such as active noise cancellation (ANC) and near field communication (NFC) at low prices.

The fitness industry has also contributed to the expansion of this category, as many individuals now use headphones and earbuds during exercise routines.

In general, while the broader demand for headphones and headsets has risen in tandem with the rise of mobile device usage, it's essential for brands to recognize these specific trends within the market in order to tap into the growing demand and differentiate themselves from competitors.

Back to School season has driven up search rankings for top terms in this category, signifying increased interest during this time. Brands prepared to tailor marketing strategies and product offerings during peak season like BTS may capture the heightened customer interest.

Marketing campaigns can emphasize the value of earphones or headphones for students and the education environment. At the same time, limited-time promotions, attractive bundles (such as combining headphones or earphones with related products like tablets or study accessories), or loyalty programs to incentivize purchases can also help brands maximize sales potential.

Now, let’s have a look at what the consumers are searching for within these respective topics, and how they have changed month-over-month (July vs June).

These are the top 10 most trending organic terms related to headphones. With most terms concentrating around Kids and School, we can see a strong indication that shoppers are preparing for Back to School season.

In the earphones category, we notice a shift towards Kids in the MoM trend. Brands recognizing the prominence of these search terms can craft marketing messages that highlight the suitability of their headphones for students, such as durability, comfort, or study-friendly features.

While wireless and Bluetooth products are the top searched items, wired products have also been trending up, mostly because of their affordability.

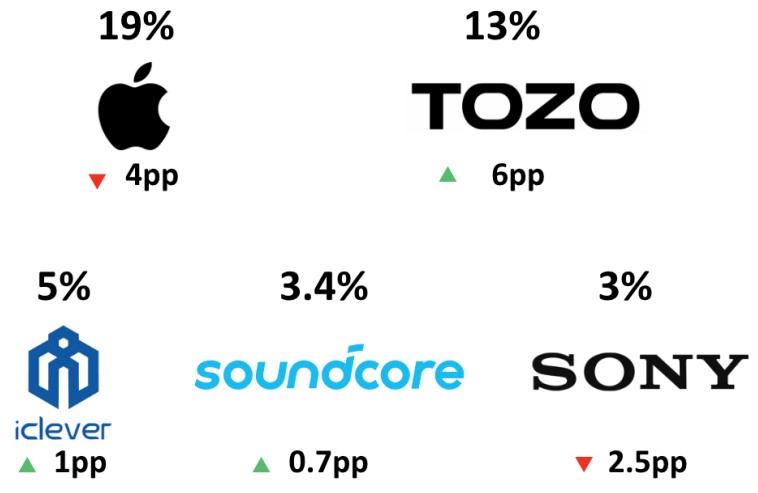

i.e. brands appearing on top generic searches organically

A smaller brand TOZO has gained presence amongst the big players after winning in search. Specifically in the earphones category, they are actively bidding on terms related to wireless earbuds. Smaller brands like TOZO can compete with larger brands by concentrating their efforts on specific product categories and optimizing their search presence.

i.e. brands bidding on the top generic searches

The Back to School period sees a surge in deal hunters, particularly parents on the lookout for colorful and more affordable products for their children. This is where brands like TOZO and iClever have built their expertise. These brands have been bidding actively on the keywords listed below to cater to this customer segment.

CommerceIQ combines Market Share with Search and Share of Voice to give you the most comprehensive category insights and strategies to outperform your competition. Reach out to us for a demo!

Interested in our category deep-dives? Check out:

1450+

retailers

100+

mobile apps

59

countries

250+

engineers and

data scientists

CommerceIQ is the only sales-focused, unified platform built specifically for ecommerce—combining sales, media and shelf data with role-specific AI teammates that deliver actionable, commerce-ready insights.